It goes without saying that Amazon seems like the most obvious starting point for many in Europe and USA but to give your business the best chance of success and reduce risk it’s important to consider other marketplaces which may be more optimal for you. We’re going to share an overview of the process we use as part of our marketplace consultancy service to help marketplace channel decisions which might help you. The outline is as follows which can also be seen on the GS1 Webinar we led on 3rd June 2020:

- Setting the criteria

- Assessing the profitability

- Choosing your operating model

- Prioritisation

1. SETTING THE CRITERIA

The first step is to have a key set of objectives, to give yourself a clear roadmap of what you expect to achieve by selling on marketplaces, both in the short and long term. These objectives and their priority will likely influence channel decisions. The first, and most obvious, is likely to be increasing sales and profit. In the long term these are viable objectives, however, the first year on marketplaces is predominantly focused on investment and getting sales velocity, with profit often following in years 2-3+. Other short term objectives should be considered beyond this and these often include:

-

- Incremental territories – diversifying your international footprint into new regions

- Brand awareness and profile – increasing brand recognition amongst target audiences

- Clearing discounted/outlet product – using marketplaces as outlet stores for off-price stock

- Price establishment – setting good practice on pricing on the market as a brand

- Product and market intelligence to support other channels – understanding what else is happening in the market to influence ecommerce strategy (lower barriers to entry than own-brand ecommerce)

- New customer acquisition – reaching a larger established audience

- Improved visibility of reseller/competitor activity online – brands are likely to be present on marketplaces due to reseller activity and understanding how it’s presented is important

- Ease and automation – level of integration and management needed by marketplace

- Trading agility – being able to switch activity on/off at a reasonable pace

Once objectives are established, they should be ranked in importance, with a focus on the top 3-5 objectives to ensure there is a clear direction moving forward.

If incremental territories are a key objective, global priorities need to be defined to establish viable regions for expansion. Smaller marketplaces are present across the world and in some regions they perform at the same level as, or outperform Amazon. However, there are a number of factors that can influence a decision to expand into a new region:

-

- Strategic growth targets – are there areas which you’re already aware offer growth potential but you’re under indexing on sales?

- ecommerce cross border sales – do you already have sales data that demonstrates where your product sells well globally?

- B2B sales – are you already facilitating sales to a region or do you have distribution agreements that exclude certain territories?

- Product compliance – are your products able to sell in these countries?

- Local VAT registry – are you setup for tax registry if required?

- Local business entity setup – is it required?

- Lingual & timezone support – is your current setup prepared to service that territory?

- Regional returns data (fashion specific) – returns can have a huge impact on profit, do you have regional returns data?

With both strategic and regional objectives in mind, we would then look into the marketplaces available to suit your needs. Marketplaces can be category specific (Zalando), discount orientated (eBay) or more general platforms (Amazon). Explore the marketplaces available in regions of interest and select those with the model that is best aligned with your objectives. This leaves you with a list of marketplaces that you’re interested in assessing.

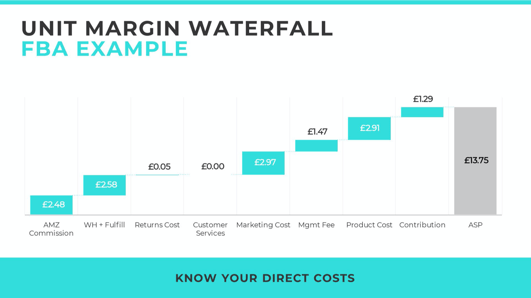

2. ASSESSING THE PROFITABILITY

|

It goes without saying that it’s fundamentally important to understand whether you’re going to make money or not. Comparing a range of operational models (different DCs/3PL/FBA options) can offer an indicative level of costs and avoid ruling out a region solely because the current arrangements make it unprofitable. It can also be worth considering a selection of delivery and return cost scenarios alongside product and sales data to formulate the most optimal logistical setup.

|

|

Although free delivery and returns are desirable, it may be that this has too much of an impact on profitability. Distribution rates can have a particularly large impact on marketplace profit as units per transaction are considerably lower than on own brand sites (1-1.5 as opposed to 2.5-3.5 often).

Greater value can be gained from this process when the costs are analysed in proper detail (don’t skip out on smaller details like relabelling costs). Warehousing and distribution costs will differ hugely depending on which product you use for analysis and its size and weight. Negate this by including a selection of products and weighting them in line with your historical sales mix (times costs by relative sales volume). Make sure not to miss out any management or integration tool fees that may be fixed. Once carried out for each marketplace, a stacked bar chart can help to easily contrast the profitability of each channel in a more visual format. At this stage, some marketplaces will offer no profitable operating models and may have to be ruled out to create a shortlist of viable options.

3. CHOOSING YOUR OPERATING MODEL

Some marketplaces operate more complex models and demand a certain level of expertise to run, where others make it simple to setup an account and get listings live. Depending on your level of experience and time available internally, there are multiple management options available:

-

- Fully outsourced – authorised reseller who works on consignment

- Hybrid – working with an agency while using internal product specialisation

- Fully in house – all elements managed internally

If Amazon is on your shortlist, FBA decisions can be a bit of a minefield. There are a number of different operational models to choose from, each with different benefits:

-

- Your DC

- FBA local – selling domestically

- FBA European Fulfillment Network – selling cross border through your UK FBA account (a premium is paid on each international order – less cost effective but higher stock efficiency)

- FBA Multi-Country Inventory – selecting pools of stock in different markets and managing internally (lower cost but less efficient – need a higher volume of sales to make this an efficient option)

- FBA Pan EU – Amazon manages stock depending on velocity of sales across 5 (soon to be 6) EU sites and brand only manages stock being sent to Amazon (simpler, more efficient, but must consider VAT registry across 7 countries – soon to be 8)

- Integrated 3PL – utilising a third party who already having distribution integrated with marketplaces to handle on your behalf

Decisions generally take into account cost, stock efficiency and the level of outside involvement desired.

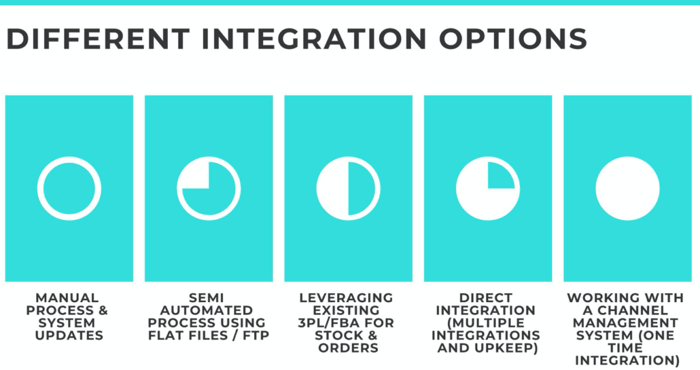

Integration options are also an important consideration as they can range from a predominantly manual operation to a fully integrated channel management system for all your marketplaces:

These choices will discern not only your cost base, but also the marketplaces you choose to list on as the ease of listing will be greatly affected. Additionally, if you choose to work with a channel management system (which is often the most scalable route) your decisions will predominantly be influenced by the marketplaces they can integrate with.

All of these operating decisions will input directly into overhead costs and what opportunity costs you may need to consider:

-

- Internal management cost

- External management cost

- Integration costs

- Stock segmentation

- Customer services

- Translation

- SaaS costs

- Launch fees

- Professional fees (legal/finance/tax)

- Design costs

These costs won’t all be relevant but you should be aware of them and think about them as part of your planning process.

4. PRIORITISATION

Once you’ve processed all this new information and have got a better idea of how you might approach the marketplace channel, it’s time to prioritise. We’d start with a scoring methodology, based on your objectives, covering brand, financial, commercial and operational factors:

-

- Brand e.g. number of competitors listing on the marketplace and number of listings in the category

- Financial e.g. assess profitability analysis alongside individual marketplace costs that may affect your impression of a marketplace’s value

- Commercial e.g. establish market size using tools such as Alexa Traffic Rank

- Operational e.g. operational ease (could be region or marketplace specific) considering your business’ strengths and weaknesses

It’s worth considering a few criteria (3-5) within each of these sections before jumping to a decision. These criteria can be chosen based on a number of sources:

-

- What data can you provide?

- What data can you access?

- What data can you gather?

- Mixture of objective and subjective

- Mixture of internal and external

- Creating simple scoring methodology (1-5 scoring works well)

This could include historical B2B data, competitor data, trends analytics, partner or marketplace papers (there’s plenty of secondary data on marketplaces). This data needs to be applied within the context of your business and subjectivity is vital – what worked for your competitor won’t necessarily work for you.

This is only a whistle-stop tour of the process we would take and it’s worth considering using elements of this strategy if you’ve already started looking at marketplace channel decisions.

If you want to explore this process in more depth or you need some additional help when carrying out your assessment please email sales@richinsight.co.uk and we’d be happy to help.

Blog Comments